Commonly known as A Chinese Wall is an ethical concept of separation between groups, departments, or individuals within the same organization. This is a virtual barrier that prohibits communications or exchanges of information that could cause conflicts of interest which is commonly used at investment banks, retail banks and brokerages.

This physical boundary, but rather an ethical one which financial institutions were expected to observe. Inside or non-public information was not allowed to past between departments or to be shared. If the investment banking team is working on a deal to take a company public, their broker buddies on the floor below are not to know about it until the announcements are made to the public. It is simply mandated to the departments. In compliance with the Central Bank to have proper controls in place. We have implemented them for FIs and listed companies.

Section 141(1)(d) of the FSA and section 153(1)(e) of the IFSA prohibits a person from taking part in or carrying out a transaction based on information that is not generally available to persons who regularly deal in the money market or foreign exchange market that would, or would tend to, have a material effect on the price or value of financial instruments.

Control Room System (CRS)

- Creation of Restriction (RL) List.

- Migration of RL List to Black-out list.

- Creation of Restriction/ Disclosure of dealing.

- Specific embargo for specific departments.

- Easily Assign Staff to Projects.

- Assigning of User Privileges for screen access.

- Reports (Export to PDF & Excel).

- Dashboard view of RL List & Black-out list Status (Active, Inactive etc.)

- Drill-down view of Dashboard information.

- Email notification (Submission & termination of RL, Submission of BL).

Sreenshots (Web):-

Trading Control System (TCS)

Features of Trading Control System (TCS)

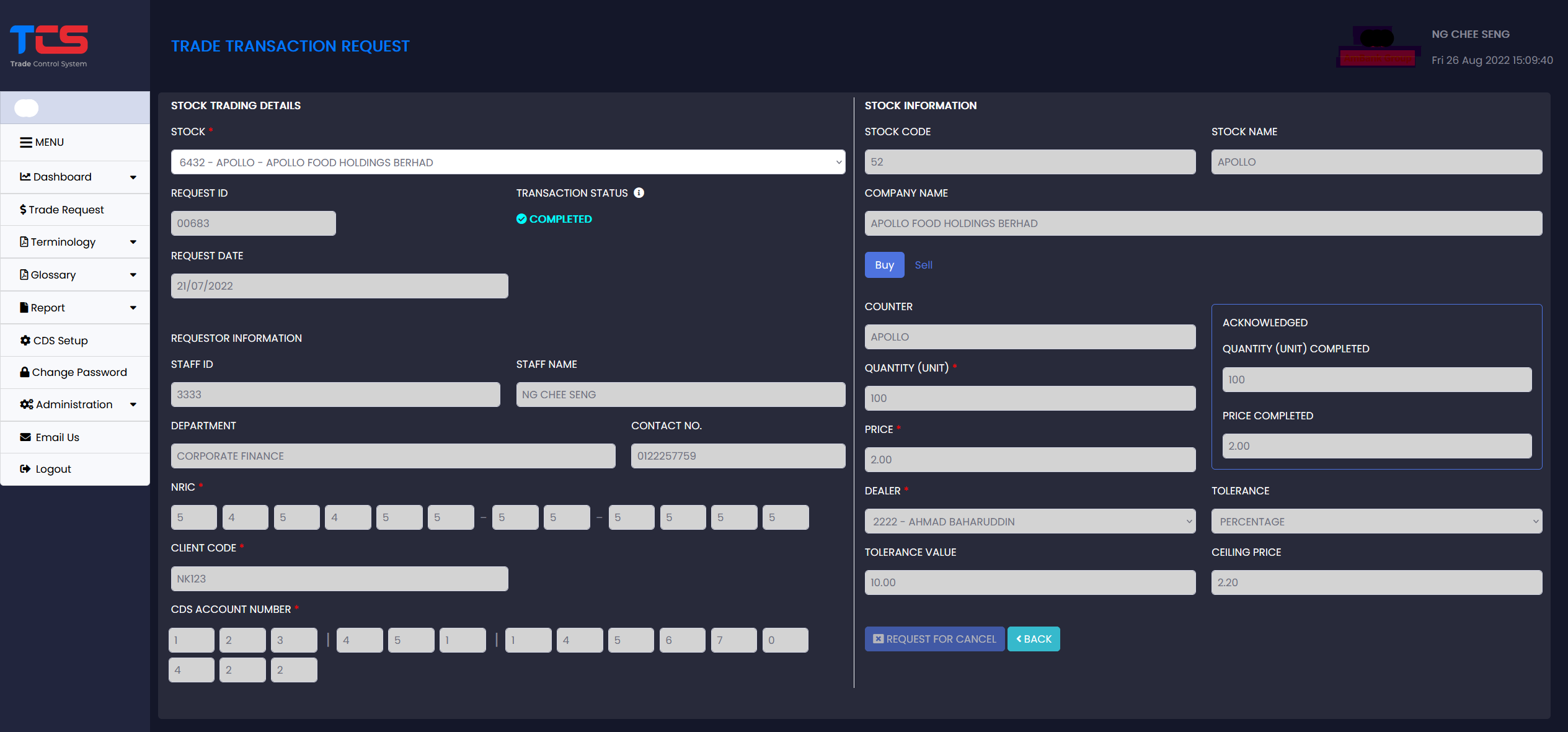

On the spot check of Staff Trading eligibility:-

- Mandatory questionnaire to access eligibility.

- Option to Request Buying or Selling of traded stock.

- Establish tolerance level for Buy/Sell .

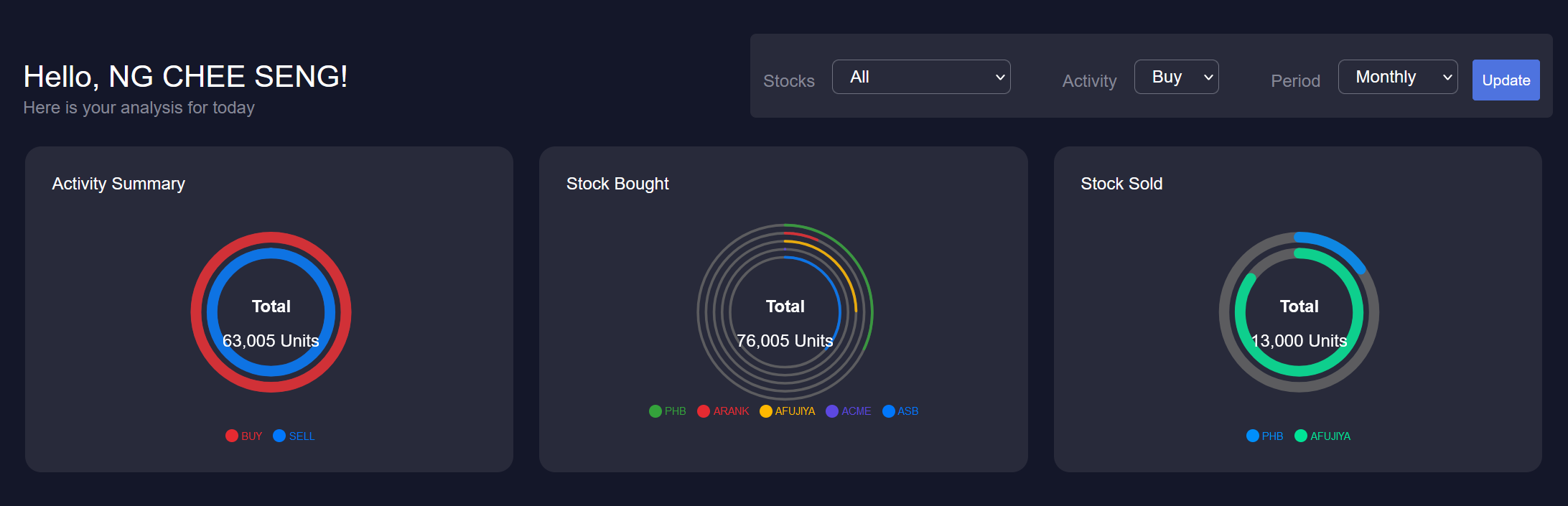

- User Dashboard of Activity Analysis.

- Security measures (e.g. confirmation of submission by entering Staff ID).

- Stock Purchase Approval.

- Email Notification (e.g., Trading confirmation).

- Personalized Dashboard based upon user category/

- Embargo of Trade by Single Date or Multiple Date selection (e.g. entity, department, user).

- Document upload of Securities Trading Account.

Sreenshots (Web):-